Use these links to rapidly review the documentTABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | ||||

Filed by a Party other than the Registrant | ||||

Check the appropriate box: | ||||

Preliminary Proxy Statement | ||||

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

Definitive Proxy Statement | ||||

Definitive Additional Materials | ||||

Soliciting Material under §240.14a-12 | ||||

JBG SMITH PROPERTIES | ||||

(Name of Registrant as Specified In Its Charter) | ||||

| N/A | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check | ||||

No fee required. | ||||

Fee paid previously with preliminary materials. | ||||

| ☐ | Fee computed on table | |||

Our Mission

Our mission is to own and operate a high-quality portfolio of Metro-served, urban-infill multifamily, office, and retail assets concentrated in the Washington region—and to grow the portfolio through value-added development and acquisitions.

We are not just measured in square feet.

Focused exclusively in our Nation’s capital region, JBG SMITH PROPERTIESis a fully integrated pure-play real estate investment trust (REIT) that owns, manages, and develops high-quality, mixed use real estate located in urban, infill locations. Our portfolio totals 17.4 million square feet of high-growth office, multifamily and retail assets at share in prime Washington, DC metro area locations, with a significant pipeline of new assets under construction and a robust collection of future development opportunities.

We are where investment meets community.

JBG SMITH is the successor to two of Washington’s most prolific, deeply rooted, regional real estate institutions and is a testament to over 65 years of building and maintaining best-in-class companies with breadth, integrity, creativity and a collaborative vision.

4445 Willard Avenue, Suite 400Message fromChevy Chase, MD 20815

February 27, 2019

Chief Executive Officer

March 17, 2022

Dear Shareholder:

You are cordially invited to the 20192022 Annual Meeting of Shareholders (the "Annual Meeting"“Annual Meeting”) of JBG SMITH Properties to be held on Thursday, May 2, 2019Friday, April 29, 2022 at 8:30 a.m., local time, at our corporate headquarters located at 4445 Willard Avenue, Suite 400, Chevy Chase, MD 20815.

EDT. This year’s Annual Meeting will be held in a virtual meeting format only. You will be able to attend the Annual Meeting virtually, vote your shares and submit questions during the Annual Meeting by visiting: www.virtualshareholdermeeting.com/JBGS2022.

At the Annual Meeting, shareholders will be asked to (i) elect four11 trustees to our Board of Trustees, (ii) approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in our Proxy Statement ("Say-on-Pay"(“Say-on-Pay”), (iii) ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2019,2022, and (iv) transact such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof. The accompanying Notice of Annual Meeting and Proxy Statement describe these matters.

Our Board of Trustees appreciates and encourages your participation in the Annual Meeting. Whether or not you plan to attend the virtual Annual Meeting, it is important that your shares be represented. Accordingly, please vote your shares by submitting your proxy. If you do attend the Annual Meeting, you may withdrawrevoke your proxy and vote in person if you so choose.

by electronically voting during the Annual Meeting.

Pursuant to rules adopted by the U.S. Securities and Exchange Commission's "noticeCommission’s “notice and access"access” rules, we have elected to provide access to our proxy materials via the Internet. Accordingly, instead of mailing printed copies of those materials to each shareholder, our proxy materials are available atwww.proxyvote.com. www.proxyvote.com. We anticipate sending a Notice of Internet Availability of Proxy Materials to our shareholders on or about March 1, 201917, 2022 that provides instructions on how to access our proxy materials on the Internet. Please read the enclosed information carefully before submitting your proxy.

Sincerely,

W. Matthew Kelly

Chief Executive Officer

| ||

| 2022 PROXY STATEMENT |

Notice of 2022 Annual Meeting

of Shareholders

JBG SMITH PROPERTIES

4445 Willard Avenue, Suite 400Chevy Chase, MD 20815

NOTICE OF 2019 ANNUAL MEETING OF SHAREHOLDERS

To be held on May 2, 2019

April 29, 2022

To the Shareholders of JBG SMITH Properties:

NOTICE IS HEREBY GIVEN that the 20192022 Annual Meeting of Shareholders (the "Annual Meeting"“Annual Meeting”) of JBG SMITH Properties, a Maryland real estate investment trust (the "Company"“Company”), will be held in a virtual meeting format at the Company's corporate headquarters located at 4445 Willard Avenue, Suite 400, Chevy Chase, MD 20815www.virtualshareholdermeeting. com/JBGS2022 on Thursday, May 2, 2019Friday, April 29, 2022 at 8:30 a.m., local time, for the following purposes:

1.To elect four trustees to the Board of Trustees to serve until the 2020 Annual Meeting and until their successors have been duly elected and qualify;2.To approve, on a non-binding advisory basis, the compensation of the Company's named executive officers as disclosed in the Company's Proxy Statement ("Say-on-Pay");3.To ratify the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2019; and4.To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

| 1. | To elect 11 trustees to the Board of Trustees to serve until the 2023 Annual Meeting of Shareholders and until their successors have been duly elected and qualify; |

| 2. | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in the Company’s Proxy Statement (“Say-on-Pay”); |

| 3. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; and |

| 4. | To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

The foregoing items of business are more fully described in the Company'sCompany’s Proxy Statement accompanying this Notice.

The Company knows of no other matters to come before the Annual Meeting. Only holders of record of the Company'sCompany’s common shares at the close of business on February 26, 201928, 2022 are entitled to notice of and to vote at the Annual Meeting or at any adjournments or postponements thereof.

Regardless of the number of shares you hold, as a shareholder your role is very important, and the Board of Trustees strongly encourages you to exercise your right to vote. Pursuant to the U.S.

Securities and Exchange Commission's "noticeCommission’s “notice and access"access” rules, the Company'sCompany’s Proxy Statement and 20182021 Annual Report to Shareholders are available online atwww.proxyvote.com.

By Order of the Board of Trustees,

Steven A. Museles

Chief Legal Officer and Corporate Secretary

March 17, 2022

Bethesda, Maryland

| Whether or not you plan to attend the virtual annual meeting, you are urged to vote by internet, by telephone, or by mail by completing, dating and signing the accompanying proxy card and returning it promptly in the postage-paid envelope provided. If you attend the annual meeting, you may revoke your proxy by electronically voting during the annual meeting. |

2 |  JBG SMITH PROPERTIES |

February 27, 2019Chevy Chase, Maryland

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE URGED TO VOTE BY INTERNET, BY TELEPHONE, OR BY MAIL BY COMPLETING, DATING AND SIGNING THE ACCOMPANYING PROXY CARD AND RETURNING IT PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED. IF YOU ATTEND THE MEETING, YOU MAY WITHDRAW YOUR PROXY AND VOTE IN PERSON.

TABLE OF CONTENTS

| 2022 PROXY STATEMENT | ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

i

JBG SMITH PROPERTIES

4445 Willard Avenue, Suite 400Chevy Chase, MD 20815

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. This Proxy Statement first will be made available to shareholders on or about February 27, 2019.March 17, 2022.

ANNUAL MEETING OF SHAREHOLDERS

Annual Meeting of Shareholders

| DATE AND TIME |  | LOCATION |  | RECORD DATE | |||||

| April 29, 2022 at 8:30 a.m. (EDT) | You can virtually attend the Annual Meeting at www.virtualshareholdermeeting.com/ JBGS2022. | February 28, 2022 | ||||||||

Number of Common Shares Outstanding and Eligible to Vote at the Meeting as of February shares |

Table of ContentsVoting Matters

Shareholders are being asked to vote on the following matters at the Annual Meeting:

| Proposals | Board Recommendation | ||

| FOR each | |||

| FOR | |||

| FOR |

OUR BUSINESS AND FORMATION

Our Business and Formation

JBG SMITH Properties is a real estate investment trust ("REIT") that owns, operates, invests in and develops real estate assets concentrateda dynamic portfolio of mixed-use properties in leading urban infillthe high growth and high barrier-to-entry submarkets in and around Washington, DC. We ownThrough an intense focus on placemaking, JBG SMITH cultivates vibrant, amenity-rich, walkable neighborhoods throughout the Washington, DC metropolitan area. Over half of JBG SMITH’s holdings are in the National Landing submarket in Northern Virginia, where it serves as the developer for Amazon’s new headquarters, and operate awhere Virginia Tech’s $1 billion Innovation Campus is under construction. JBG SMITH’s portfolio currently comprises 17.4 million square feet of high-qualityhigh-growth office, multifamily and multifamilyretail assets manyat share, 98% of which are amenitized with ancillary retail. Our third-party real estate services business provides fee-based real estate servicesmetro-served. It also maintains a development pipeline encompassing 16.6 million square feet of mixed-use development opportunities. JBG SMITH is committed to our real estate ventures, legacy funds formerly organized by The JBG Companies® ("JBG Legacy Funds")the operation and other third parties.

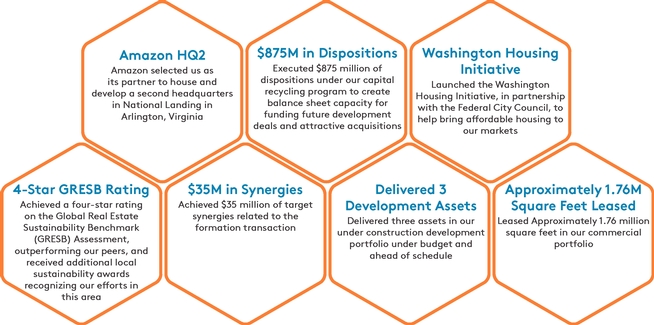

2018 Business Performance Highlights

In 2018, we achieved several significant accomplishments, including:

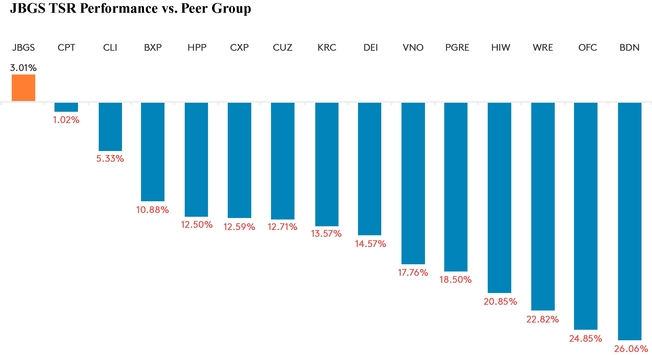

In addition, our 2018 total shareholder return ("TSR"), as described in the section titled "Compensation Discussiondevelopment of green, smart, and Analysis — Elements of Executive Compensation Program — 2018 Annual Equity Grants," significantly exceeded that of our peer group.healthy buildings and plans to maintain carbon neutral operations annually.

| 4 | JBG SMITH PROPERTIES |

2021 Business Performance Highlights

Paved the way for Amazon’s continued expansion and expanded growth footprint surrounding Virginia Tech’s $1 Billion Innovation Campus in National Landing Over 210,000 retail square feet, representing over 50 new retailers, well underway in National Landing Establishing National Landing as first 5G-enabled connected city at scale in the country Completed 1.7 million square feet of office leasing activity | Grew multifamily occupancy and rents and expanded multifamily portfolio by 3,313 units through development and acquisitions at an average yield of 5.9% Advanced design and entitlement on 11.3 million square feet, or 77%, of our Development Pipeline Concentrating portfolio in multifamily and National Landing office by successfully recycling non-core office and land holdings | Preserved our balance sheet strength and liquidity Leading the market on ESG initiatives, including achieving carbon neutrality for energy consumed across our operating portfolio |

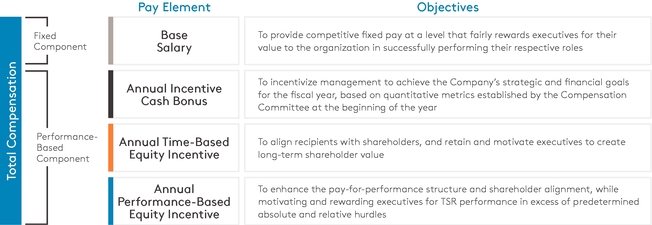

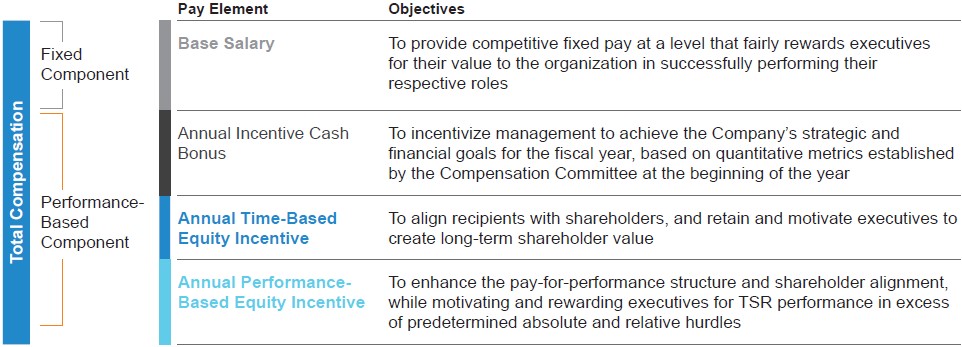

Our executive compensation program emphasizes performance over the long term by focusing on three important goals:

•Alignment with shareholder interestsby requiring significant share ownership, tying substantial portions of pay to performance and paying a

sizable portionmajority of compensation in equity subject to performance and multi-year vesting periods;•Attracting and retaining the highest caliber executiveswho possess the skills to continue to grow and manage our business successfully; and

•Motivating our executivesto achieve corporate and individual objectives.

Annual Executive Compensation Elements and Objectives

| 2022 PROXY STATEMENT | 5 |

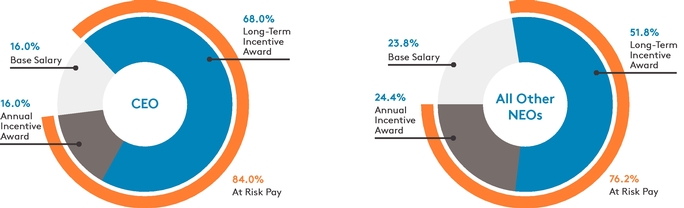

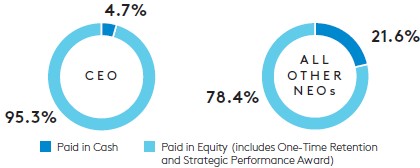

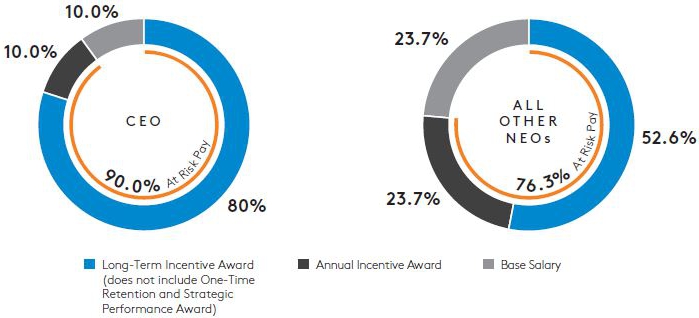

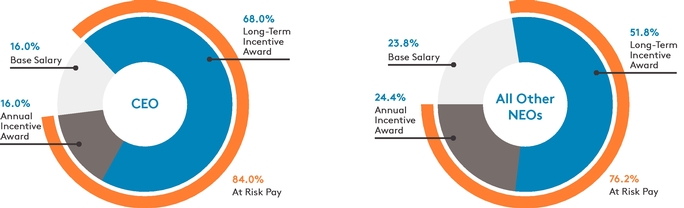

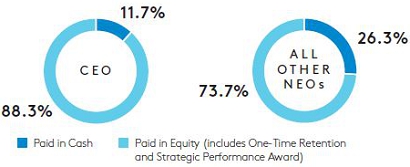

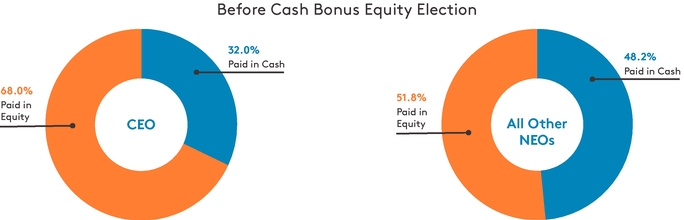

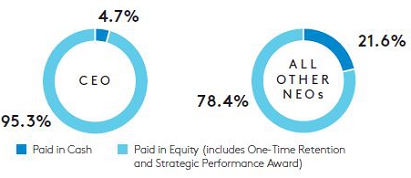

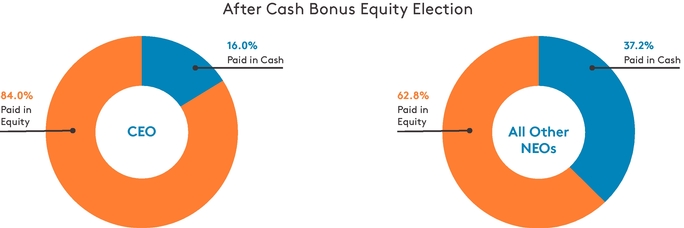

20182021 Executive Target Pay Mix

As described in the section titled "Elements“Elements of Executive Compensation Program"Program” below, W. Matthew Kelly and David P. Paul and Steven W. Theriot each elected to receive 100%, 100% and 50%, respectively, of their 20182021 cash bonuses in the form of equity awards.

2018 Actual Executive Pay Mix Before and

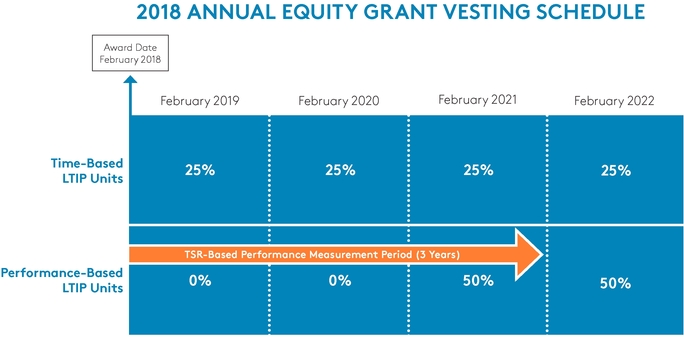

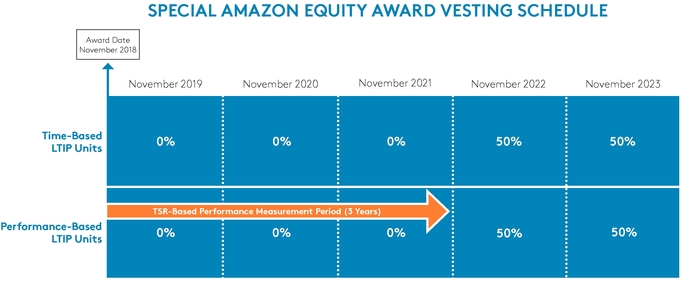

| 2021 Actual Executive Pay Mix Before and After Cash Bonus Equity Election | Annual Performance-Based Equity Structure | |

| Before Cash Bonus Equity ElectionAfter |  | |

| ||

| After Cash Bonus Equity Election | ||

|

| 6 | JBG SMITH PROPERTIES |

Corporate Governance Highlights

Performance-Based Equity Structure

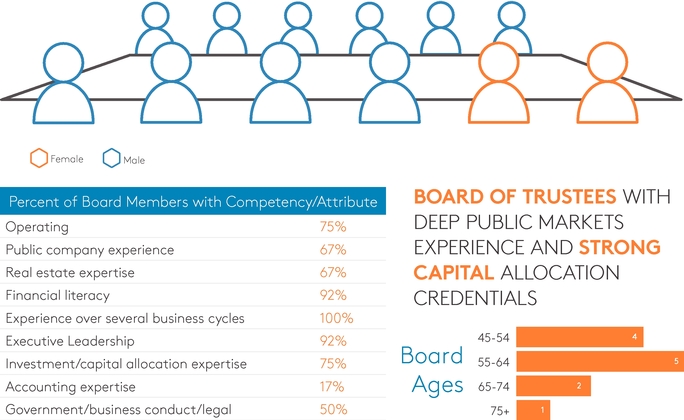

CORPORATE GOVERNANCE HIGHLIGHTS

Our corporate governance is structured in a manner that the Board of Trustees (the "Board"“Board”) believes closely aligns the Company'sCompany’s interests with those of our shareholders.

In early 2018, theOur Board adopted and implemented several significant governance changes. These changes were initiated by theits Corporate Governance and Nominating Committee which commenced a reviewremain attentive to and analysis of the Company'sconsider proposed corporate governance provisions. As part of this process the Corporate Governance and Nominating Committee reviewed industry best practices, comparable governance provisions both within and outside of the public real estate industry and also included input that management proactively obtained from the corporate governance and stewardship units of some of the Company's largest shareholders. This comprehensive review and analysis enabled the Corporate Governance and Nominating Committee to evaluate the Company's corporate governance elections. The Corporate Governance and Nominating Committee considered proposed changes with two overarching principles in mind: (i) that governance of a public company by the majority of its shareholders is fair, and (ii) that the Company should align itself with the governance practices of corporate America generally, not just REITs. Based on its review and analysis our Corporate Governance and Nominating Committee, together with management, recommended to our Board, and our Board approved, the following shareholder-aligned changes to our governance structure:

•Granted shareholders a new right (previously reserved for the Board) to amend the bylaws if a specified voting threshold is met – a majority vote of shares entitled to be cast on the matter;•Granted shareholders a new right (previously reserved for the Board and management) to call a special meeting of shareholders if a specified voting threshold is met – a majority of shares entitled to be cast on the matter;•Opted out of the Maryland Unsolicited Takeovers ("MUTA") (a portion of which was approved by our shareholders at our last annual meeting), a provision uniquely applicable to Maryland corporations and which, in the absence of not opting out, could be viewed as providing publicly traded entities organized in Maryland, like the Company, with certain defenses that might be utilized to entrench the Board and/or management; and•Opted out of the Maryland Business Combination Act ("MBCA"), which, in the absence of opting out, could inhibit a third party from making a proposal to acquire us or impede a change of control.

While the foregoing governance changes were implemented in 2018, our Board and its Corporate Governance and Nominating Committee remain attentive to and focused on shareholder alignment and intend to continue to follow the two principals described above regarding majority rule and governance practices of corporate America generally when considering the corporate governance of our Company.

Notable features of our corporate governance structure include the following:

| SHAREHOLDER ALIGNMENT | |||

| Annual election of Trustees | |

| ✓

| Majority voting for election |

| ✓ | Shareholder proxy access |

| ✓

| 9 out of |

| ✓

| Share ownership requirements for |

| ✓ | Policy |

| No “poison pill” |

| ✓ | Shareholders may amend the bylaws by a majority vote of shares entitled to be cast |

| ✓

| “Claw back” policy for performance-based compensation |

| ✓ | Diversity of skills, experience, gender and backgrounds of Trustees |

| ✓ | Shareholders may call a special meeting of shareholders if a specified voting threshold is met |

| ✓

| The Company has opted out of the |

| ✓ | The Company has opted out of the Maryland Business Corporation Act |

| 2022 PROXY STATEMENT | 7 |

Questions and Answers about the Annual Meeting

JBG SMITH PROPERTIES

4445 Willard Avenue, Suite 400Chevy Chase, MD 20815

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Why am I receiving this Proxy Statement?

This Proxy Statement is furnished by the Board of Trustees (the "Board"“Board”) of JBG SMITH Properties in connection with the Board'sBoard’s solicitation of proxies for the 20192022 Annual Meeting of Shareholders of JBG SMITH Properties (the "Annual Meeting"“Annual Meeting”) to be held in a virtual meeting format at www.virtualshareholdermeeting.com/JBGS2022 on Thursday, May 2, 2019Friday, April 29, 2022 at 8:30 a.m., local time, at our at our corporate headquarters located at 4445 Willard Avenue, Suite 400, Chevy Chase, MD 20815,EDT, and at any adjournments or postponements thereof. This Proxy Statement will first will be made available to shareholders on or about February 27, 2019.March 17, 2022.

We maintain a website atwww.jbgsmith.com. Information on or accessible through our website is not and should not be considered part of this Proxy Statement.

Unless the context requires otherwise, references in this Proxy Statement to "JBG“JBG SMITH," "we," "our," "us"” “we,” “our,” “us” and the "Company"“Company” refer to JBG SMITH Properties, a Maryland real estate investment trust ("REIT"(“REIT”), together with its consolidated subsidiaries. References to our "formation transaction" refer to our separation from Vornado Realty Trust ("Vornado") and subsequent acquisition of the management business and certain assets of The JBG Companies® ("JBG") to become an independent publicly traded company. Following the formation transaction, JBG SMITH became an independent, publicly traded company listed on the New York Stock Exchange under the ticker symbol "JBGS".

Why did I not automatically receive a paper copy of the Proxy Statement, proxy card and Annual Report?

Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the "SEC"“SEC”), we have elected to provide access to our proxy materials via the Internet. Accordingly, rather than paper copies of our proxy materials, we are sending a Notice of Internet Availability of Proxy Materials (the "Proxy Notice"“Proxy Notice”) to our shareholders that provides instructions on how to access our proxy materials on the Internet. Shareholders may follow the instructions in the Proxy Notice to elect to receive future proxy materials in print by mail or electronically by email.

What am I being asked to vote on?

You are being asked to vote on the following proposals:

•- Proposal 1 (Election of Trustees): The election of the

four11 trustee nominees to the Board to serve until the20202023 Annual Meeting of Shareholders (the"2020“2023 AnnualMeeting"Meeting”) and until their successors have been duly elected and qualify;•- Proposal 2 (Say-on-Pay): The approval, on a non-binding advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement (the

"Say-on-Pay vote"“Say-on-Pay vote”); and•- Proposal 3 (Ratification of the appointment of Deloitte & Touche LLP): The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31,

2022.2019.Our Board knows of no other matters to be brought before the Annual Meeting.

What are the

Board'sBoard’s voting recommendations?The Board recommends that you vote as follows:

•- Proposal 1 (Election of Trustees): “FOR”

"FOR"each of theBoard'sBoard’s nominees for election as trustees;•Proposal 2 (Say-on-Pay): “FOR”"FOR"the approval, on a non-binding advisory basis, of the compensation of ourCompany'sCompany’s named executive officers as disclosed in this Proxy Statement; and•Proposal 3 (Ratification of the appointment of Deloitte & Touche LLP): “FOR”"FOR"ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31,2019.2022.8 JBG SMITH PROPERTIES Who is entitled to vote at the Annual Meeting?

The close of business on February

26, 201928, 2022 has been fixed as the record date (the"Record Date"“Record Date”) for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting. Only holders of record of our common shares of beneficial interest("(“commonshares"shares”) as of the close of business on the Record Date, or their duly appointed proxies, are entitled to receive notice of, to attend, and to vote at the Annual Meeting. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in"street“street name,"” and you must obtain a proxy from your brokerage firm, bank, broker-dealer, trustee or nominee giving you the right to vote the shares at the Annual Meeting. On the Record Date, our outstanding voting securities consisted of122,593,995127,273,215 common shares.What are the voting rights of shareholders?

Each common share is entitled to one vote on each matter to be voted. Votes in the election of trustees may not be cumulated.

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the shareholder of record with respect to those shares, and the Proxy Notice was sent directly to you by us.

In that case, ifIf you are a shareholder of record, you may attend the virtual Annual Meeting and vote electronically during the Annual Meeting. If you choose not to attend and vote at the Annual Meeting,and vote in person,you may instruct the proxy holders named in the proxy card how to vote your common shares in one of the followingways:ways until 11:59 P.M. Eastern Time on April 28, 2022:•• Vote online. You can access proxy materials and vote at www.proxyvote.com. To vote online, you must have a shareholder identification number provided in the Proxy Notice. Vote online.You can access proxy materials and vote atwww.proxyvote.com. To vote online, you must have a shareholder identification number provided in the Proxy Notice.•- Vote by telephone.

If you received printed materials, youYou also have the option to vote by telephone by following the"Vote“Vote byPhone"Phone” instructions on the proxy card.

•- Vote by regular mail. If you received printed materials and would like to vote by mail, please mark, sign and date your proxy card and return it promptly in the postage-paid envelope provided.

If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in

"street“street name,"” and the Proxy Notice was forwarded to you by that organization. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. If you choose not to attend and vote at the Annual Meeting,and vote in person,you should instruct your broker or nominee how to vote your shares by following the voting instructions provided by your broker or nominee. If you request printed copies of the proxy materials by mail, you will receive avotevoting instruction form for this purpose.Of course, you always may choose to attend the virtual Annual Meeting and vote your shares

in person.electronically during the Annual Meeting. If you do attend the virtual Annual Meeting and have already submitted a proxy, you may withdraw your proxy and votein person.electronically during the Annual Meeting.How are proxy card votes counted?

Proxies submitted properly via one of the methods discussed above will be voted in accordance with the instructions contained therein. If the proxy is submitted but voting directions are not

made,given, the proxy will be voted"FOR"“FOR” each of thefour11 trustee nominees,"FOR"“FOR” approval, on a non-binding advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement, and"FOR"“FOR” ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31,2019,2022, and in such manner as the proxy holders named on the proxy (the"Proxy Agents"“Proxy Agents”), in their discretion, determine upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, under applicable rules of the New York Stock Exchange (the

"NYSE"“NYSE”) (the exchange on which our common shares are traded), the brokers will vote your shares according to the specific instructions they receive from you. If brokers that hold our common shares for a beneficial owner do not receive voting instructions from that owner at least 10 days prior to the Annual Meeting, the broker may vote only onthea proposal if it is considered a"routine"“routine” matter under theNYSE'sNYSE’s rules. On"non-routine"“non-routine” matters, brokers do not have discretionary voting power and cannot vote without instructions from the beneficial owners, resulting in a so-called"broker“broker non-vote."” Pursuant to the rules of the NYSE, the election of trustees and the Say-on-Pay proposals each are"non-routine"“non-routine” matters, and brokerage firms may not vote on these matters without instructions from their clients, resulting in broker non-votes. In contrast, ratification of the appointment of an independent registered public accounting firm is considered a"routine"“routine” matter underNYSE'sNYSE’s rules, which means that brokers have discretionary voting authority to the extent they have not received voting instructions from their client on the matter.2022 PROXY STATEMENT 9 How many votes are needed for the proposals to pass?

The proposals to be voted on at the Annual Meeting have the following voting requirements:•Proposal 1 (Election of Trustees):With respect to Proposal One,For each proposal, you may vote"FOR"“FOR,” “AGAINST” or “ABSTAIN”. A majority of allnominees, "WITHHOLD" your vote as to all nominees, or "FOR" all nominees except those specific nominees from whom you "WITHHOLD" your vote. Pursuant to our bylaws, trustees will be elected by a plurality ofvotes castat the Annual Meeting, withis required to elect eachshare being entitled to vote for as many individuals as there are trustees to be elected and for whose election the share is entitled to vote. Therefore, the fourtrusteenominees receiving the highest number of

"FOR" votes will be elected. There is no cumulative voting in the election of trustees. For purposes of the election of trustees, abstentions, votes marked "WITHHOLD" and other shares not voted (whether by broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the result of the vote. However, both abstentions and broker non-votes will count toward the presence of a quorum.•Proposal 2 (Say-on-Pay):You may vote "FOR," "AGAINST" or "ABSTAIN" on Proposal Two. The affirmative vote of a majority of the votes cast at the Annual Meeting is required(Proposal 1), to approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in this ProxyStatement. For purposesStatement (Proposal 2), and to ratify the appointment ofthe vote on Proposal Two, aDeloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022 (Proposal 3). A majority oftheall votes cast means that the shares voted"FOR"“FOR” the proposal must exceed the votes"AGAINST"“AGAINST” the proposal, and therefore abstentions and other shares not voted (whether by broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the result of the vote. However, both abstentions and broker non-votes will count toward the presence of a quorum.•Proposal 3 (Ratification of the Appointment of Deloitte & Touche LLP):You may vote "FOR," "AGAINST" or "ABSTAIN" on Proposal Three. Pursuant to our bylaws, the affirmative vote of a majority of the votes cast at the Annual Meeting is required to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2019. For purposes of the vote on Proposal Three, a majority of the votes cast means that the shares voted "FOR" the proposal must exceed the votes "AGAINST" the proposal, and therefore abstentions and other shares not voted will not be counted as votes cast and will have no effect on the result of the vote. However, abstentions will count toward the presence of a quorum.

What will constitute a quorum at the Annual Meeting?

Holders representing a majority of all votes of our outstanding common shares entitled to be cast at the Annual Meeting must be present,

in personby means of remote communication, at the Annual Meeting or by proxy, for a quorum to exist. If the shares present in person via attendance at the virtual Annual Meeting or by proxy at the Annual Meeting do not constitute a quorum, the Annual Meeting may be adjourned to a subsequent time. Shares that arevoted "FOR," "AGAINST"properly submitted by you or"ABSTAIN"on your behalf will be treated as being present at the Annual Meeting for purposes of establishing a quorum. Accordingly, if you have returned a valid proxy or attend the virtual Annual Meeting,in person,your shares will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters at the Annual Meeting. Broker non-votes also will be counted as present for purposes of determining the presence of a quorum.If I plan to attend the Annual Meeting, should I still vote by proxy?

Yes. Voting in advance does not affect your right to attend the virtual Annual Meeting. If you send in your proxy card and also attend the Annual Meeting, you do not need to vote again at the Annual Meeting unless you want to change your vote.

Written ballots will be available atYou may revoke your proxy by electronically voting during themeeting for shareholders of record. If you are not a shareholder of record but hold shares through a broker or nominee (i.e., in street name), youAnnual Meeting. You may vote electronically during the Annual Meeting at www.virtualshareholdermeeting.com/JBGS2022 by entering yourshares in person only if you obtain a legal proxy from16-digit control number and following thebroker, trustee or nominee that holds your shares giving you the right to vote the shares.instructions. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions prior to the meeting as described above so that your vote will be counted if you later decide not to attend the meeting.Who can attend, vote and ask questions at the Annual Meeting?

Only shareholders as of the Record Date, or their duly appointed proxies, may attend the virtual Annual Meeting.

Shareholders may be askedTo enter the Annual Meeting and have the ability topresent valid picture identification such as a driver's license or passport and proofsubmit questions during the Annual Meeting, shareholders must have their 16-digit control number available, which is provided in the Notice ofshare ownership asInternet Availability ofthe Record Date. If you are not aProxy Materials. Only one shareholderof record but hold shares through a broker or nominee (i.e., in street name), you should provide proof ofbeneficial ownership on the Record Date, such as your most recent account statement, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership. The use of cell phones, smartphones, cameras, sound or video recording, or other similar equipment or electronic devices, and/or computers is not permitted atper 16-digit control number can access the Annual Meeting.For directionsWe encourage shareholders to log in to the website and access the virtual Annual Meeting before the Annual Meeting’s start time.Shareholders may vote electronically during the Annual Meeting

contact Investor Relationsat(240) 333-3203www.virtualshareholdermeeting.com/JBGS2022 by entering your 16-digit control number and following the instructions.During the Annual Meeting, we will endeavor to answer as many questions submitted by shareholders as time permits. We reserve the right to exclude questions regarding topics that are not pertinent to meeting matters or

emailcompany business. If we receive substantially similar questions, we may group such questions together and provide a single response to avoid repetition.ir@jbgsmith.com.What if I have technical difficulties or trouble accessing the virtual meeting?If you encounter any technical difficulties accessing the virtual meeting or during the virtual meeting, please call: 1-844-986-0822, or if calling internationally, please call: 1-303-562-9302. We will have technicians ready to assist you.

Will any other matters be voted on?

The proposals set forth in this Proxy Statement constitute the only business that the Board intends to present at the Annual Meeting. The proxy does, however, confer discretionary authority upon the Proxy Agents or their substitutes to vote on any other business that may properly come before the meeting. If the Annual Meeting is postponed or adjourned, the Proxy Agents can vote your shares on the new meeting date as well, unless you have revoked your proxy.

Can I change my vote after I have voted?

You may revoke your proxy at any time prior to its use by (i) delivering a written notice of revocation to our Secretary, (ii) filing a duly executed proxy bearing a later date with us or (iii) attending the Annual Meeting and voting

in person.electronically during the Annual Meeting. If your common shares are held by a broker, bank or any other persons holding common shares on your behalf, you must contact that institution to revoke a previously authorized proxy.10 JBG SMITH PROPERTIES Who is soliciting proxies for the Annual Meeting and who is paying for such solicitation?

The

enclosedproxy for the Annual Meeting is being solicited by the Board. We will pay the costs of soliciting proxies. In addition to soliciting proxies by mail, certain of our trustees, officers and employees may solicit proxies by telephone, personal contact or other means of communication. They will not receive any additional compensation for these activities. In addition, we will, upon request, reimburse brokers, banks and other persons holding common shares on behalf of beneficial owners for the reasonable expenses incurred by them in forwarding proxy materials to beneficial owners.No person is authorized to give any information or to make any representation not contained in this Proxy Statement, and, if given or made, you should not rely on that information or representation as having been authorized by us. The delivery of this Proxy Statement does not imply that the information herein has remained unchanged since the date of this Proxy Statement.

Whom should I call if I have questions or need assistance voting my shares?

Please call Investor Relations at (240)

333-3643333-3805 or emailjmarcus@jbgsmith.combrodgers@jbgsmith.com if you have any questions in connection with voting your shares.2022 PROXY STATEMENT 11 PROPOSAL ONE: ELECTION OF TRUSTEES

Election of TrusteesThe Board has set the number of trustees at

12. We currently have a classified board, but will transition to an unclassified board by our 2020 Annual Meeting.11. Our declaration of trustdivides our Board into three classes. The terms of the first and third classes expire at our 2020 Annual Meeting, and the current term of the second class expires at the 2019 Annual Meeting. Shareholders elect only one class of trustees each year. The trustee nominees for election by shareholders at this Annual Meeting will serve a one-year term, which will expire at the 2020 Annual Meeting. Commencing with the 2020 Annual Meeting,provides that each trustee will be elected annually for a term of one year and shall hold office until the next succeeding annual meeting and until a successor is duly elected and qualifies. There is no cumulative voting in the election of trustees.At our 2018 Annual MeetingEach ofShareholders,thefirst class of trustees was elected to serve on our Board until our 2020 Annual Meeting and until their respective successors are elected and qualify. The fourindividualsdesignatedbelowas Class II Trustee Nominees, each of whomcurrently serves on our Board,haveand each has been recommended by our Corporate Governance and Nominating Committee and nominated by our Board to serve on the Board until our20202023 Annual Meeting and until their respective successors are elected and qualify. Based on its review of the relationships between the trustees and the Company, the Board has determined that all of our trustees, exceptSteven Roth, Mitchell N. Schear, Michael J. Glosserman,W. Matthew Kelly and Robert A. Stewart, are independent under applicable SEC and NYSE rules.Pursuant to the Master Transaction Agreement (the "Master Transaction Agreement"), dated as of October 31, 2016, that resulted in the formation transaction, Vornado and JBG each appointed six of our 12 trustees (the "Vornado Board Designees" and the "JBG Board Designees," respectively). Our bylaws name Scott A. Estes, Alan S. Forman, Michael J. Glosserman, W. Matthew Kelly, Ellen Shuman and Robert A. Stewart as JBG Board Designees and Charles E. Haldeman, Jr., Carol A. Melton, William J. Mulrow, Steven Roth, Mitchell N. Schear and John F. Wood as Vornado Board Designees. For additional information on other governance provisions mandated by the Master Transaction Agreement, see "Corporate Governance and Board Matters — Corporate Governance Profile."The Board has no reason to believe that any of the persons named below as a nominee for our Board will be unable, or will decline, to serve as a member of the Board if elected. If any nominee is unavailable for election or service, the Board may designate a substitute nominee, and the Proxy Agents will vote for the substitute nominee recommended by the Board. Under these circumstances, the Board also may, as permitted by our bylaws, decrease the size of the Board.

The Corporate Governance and Nominating Committee has set forth a written policy including minimum qualifications that a trustee candidate must possess. In addition, the written policy sets forth certain additional qualities and skills that, while not a prerequisite for nomination, should be considered by the Corporate Governance and Nominating Committee when evaluating a particular candidate. See

"Corporate“Corporate Governance and Board Matters — Trustee Nominee Selection Process."”Nominees for Election as Trustees

The table below sets forth the names of

the foureach of our trustee nominees,and the other membersall ofthe Boardwhose termsdo notwill expire at the 2023 Annual Meeting.All of our trustees have served since the formation transaction in July 2017.For each person, the table lists the age, as well as the current positions and offices with theCompany currently.Company.Name Position with the Company Served as

Trustee sinceAge as of the

Annual MeetingPhyllis R. Caldwell Trustee 2021 62 Scott A. Estes Trustee 2017 51 Alan S. Forman Trustee 2017 56 Michael J. Glosserman Trustee 2017 76 Charles E. Haldeman, Jr. Trustee 2017 73 W. Matthew Kelly Trustee, Chief Executive Officer 2017 49 Alisa M. Mall Trustee 2020 44 Carol A. Melton Trustee 2017 67 William J. Mulrow Trustee 2017 66 D. Ellen Shuman Trustee 2017 67 Robert A. Stewart Chairman of the Board 2017 60 12 JBG SMITH PROPERTIES Name Position with the Company Age as of the

Annual

MeetingYear Term

Will Expire Nominees for Election to Serve as Trustees Until the 2020 Annual Meeting (Class II) Alan S. Forman Trustee 53 2020

Michael J. Glosserman

Trustee

73

2020

Charles E. Haldeman, Jr.

Trustee

70

2020

Carol A. Melton

Trustee

64

2020

Trustees Serving as Trustees Until the 2020 Annual Meeting (Class I) W. Matthew Kelly Trustee, Chief Executive Officer 46 2020

Mitchell N. Schear

Trustee

60

2020

Ellen Shuman

Trustee

64

2020

John F. Wood

Trustee

49

2020

Trustees Serving as Trustees Until the 2020 Annual Meeting (Class III) Scott A. Estes Trustee 48 2020

William J. Mulrow

Trustee

63

2020

Steven Roth

Chairman of the Board

77

2020

Robert A. Stewart

Trustee, Executive Vice Chairman

57

2020Set forth below is biographical information of each of our trustee

nominees (Class II) and the other members of the Board who will continue to serve following the Annual Meeting (Classes I and III).nominees.Trustee Nominees (Class II)Alan S. Forman.Mr. Forman serves as a Director of Investments at the Yale University Investments Office, the team charged with managing the University's $25 billion endowment fund. Mr. Forman joined the Investments Office in October 1990 as a Senior Financial Analyst and has served as a Director of Investments since October 1997. In October 1992 and October 1994, he was promoted to Senior Associate and Associate Director, respectively. Mr. Forman also serves on the Board of Directors of Stemline Therapeutics, where he is the chair of the Nominating and Corporate Governance Committee and a member of the Audit and Compensation Committees. Mr. Forman served on the Board of Trustees of Acadia Realty Trust (NYSE: AKR), where he served as Chairman of the Compensation Committee and was a member of the Nominating and Corporate Governance Committee. Mr. Forman also served on the Board of Directors of Kimpton Group Holdings, which was ultimately sold to Intercontinental Hotels Group. He served on the Compensation and Nominating and Governance Committees at Kimpton Group Holdings. Mr. Forman received a Bachelor of Arts from Dartmouth College and a Master of Business Administration from the Stern School of Business at New York University. Mr. Forman is a JBG Board Designee.Mr. Forman was selected to serve on our Board based on his experience overseeing real estate investments for Yale University's endowment and, in that capacity, his longstanding investment relationship with the JBG Legacy Funds.Michael J. Glosserman.Mr. Glosserman worked at JBG from March 1979 until June 2017, and he served as a Managing Partner and member of JBG's Executive Committee from 2008 until June 30, 2017. He began his career as a staff attorney with the U.S. Department of Justice in March 1971,Phyllis R. Caldwell INDEPENDENT TRUSTEE

Age: 62

Trustee Since: 2021

Committees: None

Other Current

Public Boards:

Ocwen Financial

Corporation, One Main

Financial Corporation,

Oaktree Specialty

Lending CorpBackground

Ms. Caldwell has been a member of our Board since 2021. Ms. Caldwell is Chair of the Board of Directors of Ocwen Financial Corporation (NYSE: OCN) (“Ocwen”), a position she has held since March 15, 2016, and has served on the Ocwen board of directors since January 2015. Ms. Caldwell is founder and managing member of Wroxton Civic Ventures, LLC, which provides advisory services on various financial, housing and economic development matters, a position she has held since January 2012. Previously, Ms. Caldwell was Chief, Homeownership Preservation Office at the U.S. Department of the Treasury, responsible for oversight of the U.S. housing market stabilization, economic recovery and foreclosure prevention initiatives established through the Troubled Asset Relief Program, from November 2009 to December 2011. Prior to such time, Ms. Caldwell held various leadership roles during her 11 years at Bank of America until her retirement from Bank of America in 2007, serving most recently as President of Community Development Banking. Since January 2022, Ms. Caldwell has served as an independent director of Oaktree Specialty Lending Corp (NASDAQ: OCSL), where she serves on the Audit Committee, Nominating and Corporate Governance Committee, Compensation Committee, and Co-Investment Committee. Since June 2021, has served as an independent director of One Main Financial (NYSE: OMF). From January 2014 to March 2021, Ms. Caldwell served as an independent director of City First Broadway. She was an independent director of Revolution Acceleration Acquisition Corp (NASDAQ: RAAC) from December 2020 to July 2021. Ms. Caldwell also serves on the boards of non-profit organizations engaged in housing and community development finance. Ms. Caldwell received her Master of Business Administration from the Robert H. Smith School of Business at the University of Maryland, College Park and holds a Bachelor of Arts in Sociology, also from the University of Maryland.

Qualifications

Ms. Caldwell was selected to serve on our Board based on her extensive experience in housing and economic matters.

Scott A. Estes INDEPENDENT TRUSTEE

Age: 51

Trustee Since: 2017

Committees: Audit (Chair), Compensation

Other Current Public Boards:

Essential Properties Realty TrustBackground

Mr. Estes served as the Executive Vice President and Chief Financial Officer of Welltower Inc. (NYSE: HCN), a real estate investment trust focused on healthcare infrastructure from January 2009 through October 2017. Mr. Estes joined Welltower Inc. in April 2003 from Deutsche Bank Securities, a financial firm, where he served as Senior Equity Analyst and Vice President from January 2000 to April 2003. Since June 2018 Mr. Estes has served on the Board of Directors of Essential Properties Realty Trust (NYSE: EPRT), a real estate investment trust that acquires, owns and manages primarily single tenant properties, where he serves as the chair of the Audit Committee and a member of the Compensation and Nominating and Corporate Governance Committees. Mr. Estes received his Bachelor of Arts from the College of William and Mary.

Qualifications

Mr. Estes was selected to serve on our Board based on his financial and business experience as Chief Financial Officer of a large real estate investment trust with responsibilities including oversight of financial reporting, capital raising and allocation, corporate finance and accounting, investor relations, FP&A, tax, legal, internal audit and investment strategy.

2022 PROXY STATEMENT 13 before moving into commercial real estate investment and development in various senior positions with the Rouse Company between March 1972 and March 1979. He currently serves on the board of directors of the CoStar Group (NASDAQ: CSGP), a provider of information, analytics and marketing services to the commercial real estate industry in the United States and United Kingdom. He received his Bachelor of Science in Economics from The Wharton School at the University of Pennsylvania and his Juris Doctor from the University of Texas Law School. Mr. Glosserman is a JBG Board Designee.Mr. Glosserman was selected to serve on our Board based on his 45 years of experience in all facets of commercial and residential real estate investment, development, and operations.Charles E. Haldeman, Jr.From July 2009 to June 2012, Mr. Haldeman served as the Chief Executive Officer of the Federal Home Loan Mortgage Corporation, a public government-sponsored enterprise that operates in the U.S. secondary mortgage market. Mr. Haldeman joined the Federal Home Loan Mortgage Corporation from Putnam Investments, where he served as President and Chief Executive Officer from November 2003 to June 2008 and Chairman from June 2008 to June 2009. Mr. Haldeman served as the Non-Executive Chairman of KCG Holdings (NYSE: KCG) from November 2013 until July 2017. Since 2012, Mr. Haldeman has served as a member of the Board of Directors of S&P Global (NYSE: SPGI), including as the Non-Executive Chairman since April 2015 and as a member of the Financial Policy and Nominating and Corporate Governance Committees. Mr. Haldeman also served as the director of DST Systems (NYSE: DST) from November 2014 until April 2018. Mr. Haldeman received his Bachelor of Arts from Dartmouth College, Summa Cum Laude, a Master of Business Administration from Harvard Business School, where he graduated with high distinction as a Baker Scholar, and a Juris Doctor from Harvard Law School. Mr. Haldeman is a Vornado Board Designee.Mr. Haldeman was selected to serve on our Board based on his managerial experience, in particular his experience overseeing the Federal Home Loan Mortgage Corporation's strategy, operating plans and financial goals.Carol A. Melton.Ms. Melton is the Chief Executive Officer and founder of Adeft Capital, a venture capital firm advising and investing in early stage companies, as well as other U.S. and international business interests. Prior to founding Adeft Capital, Ms. Melton served as Executive Vice President for Global Public Policy at Time Warner (NYSE: TWX), a multinational media and entertainment company, from June 2005 until August 2018. In her role at Time Warner, Ms. Melton was responsible for overseeing the company's policy activities worldwide and managing its worldwide portfolio. Ms. Melton joined Time Warner from Viacom (NASDAQ: VIAB), where she served as Executive Vice President for Government Relations from June 1997 to June 2005. Ms. Melton is a member of the Council on Foreign Relations and serves on the Board of Directors and as First Vice President of the Economic Club of Washington, DC. Ms. Melton is also a Director of Halcyon and Georgetown Heritage. Ms. Melton received her Bachelor of Arts degree from Wake Forest University, a Master of Arts from the University of Florida and a Juris Doctor from the Washington College of Law at American University. Ms. Melton is a Vornado Board Designee.Ms. Melton was selected to serve on our Board based on her experience in strategic oversight of policy-related activities for global businesses.Class I TrusteesW. Matthew Kelly.Mr. Kelly serves as our Chief Executive Officer and a member of the Board. Mr. Kelly worked at JBG from August 2004 until the formation transaction and served as Managing Partner and a member of JBG's Executive Committee and Investment Committee from 2008 until the formation transaction. Mr. Kelly was responsible for the day-to-day oversight of JBG's investment strategy and the investment and acquisition activity of the JBG Legacy Funds. Prior to joining JBG, he was co-founder of ODAC Inc., a media software company, which he helped start in March 2000, and prior to that worked in private equity and investment banking as an analyst with Thomas H. LeeAlan S. Forman INDEPENDENT TRUSTEE

Age: 56

Trustee Since: 2017

Committees: Corporate Governance and Nominating (Chair), CompensationBackground

From October 1997 until March 2022, Mr. Forman served as a Director of Investments at the Yale University Investments Office, the team charged with managing the University’s $42 billion endowment fund. Mr. Forman joined the Investments Office in October 1990 as a Senior Financial Analyst, and in October 1992 and October 1994, was promoted to Senior Associate and Associate Director, respectively. Mr. Forman previously served on the Board of Directors of Stemline Therapeutics Inc. (NASDAQ: STML), where he was the chair of the Nominating and Corporate Governance Committee and a member of the Audit and Compensation Committees. Mr. Forman also previously served on the Board of Trustees of Acadia Realty Trust (NYSE: AKR), where he served as Chairman of the Compensation Committee and was a member of the Nominating and Corporate Governance Committee. Mr. Forman also served on the Board of Directors of Kimpton Group Holdings, which was ultimately sold to Intercontinental Hotels Group (NYSE: IHG). He served on the Compensation and Nominating and Governance Committees at Kimpton Group Holdings prior to its sale. Mr. Forman received a Bachelor of Arts from Dartmouth College and a Master of Business Administration from the Stern School of Business at New York University.

Qualifications

Mr. Forman was selected to serve on our Board based on his experience overseeing real estate investments for Yale University’s endowment and, in that capacity, his longstanding investment relationship with the legacy funds formerly organized by The JBG Companies.

Michael J. Glosserman INDEPENDENT TRUSTEE

Age: 76

Trustee Since: 2017

Committees: Corporate Governance and Nominating

Other Current Public Boards: CoStar Group, Inc.Background

Mr. Glosserman worked at JBG from March 1979 until June 2017, and he served as a Managing Partner and chair of JBG’s Executive Committee from 2008 until June 2017. He began his career as a staff attorney with the U.S. Department of Justice in March 1971, before moving into commercial real estate investment and development in various senior positions with the Rouse Company between March 1972 and March 1979. He currently serves on the board of directors of the CoStar Group, Inc. (NASDAQ: CSGP), a provider of information, analytics and marketing services to the commercial real estate industry in the United States and United Kingdom. He received his Bachelor of Science in Economics from The Wharton School at the University of Pennsylvania and his Juris Doctor from the University of Texas Law School.

Qualifications

Mr. Glosserman was selected to serve on our Board based on his 50 years of experience in all facets of commercial and residential real estate investment, development, and operations.

14 JBG SMITH PROPERTIES Partners in Boston, and Goldman Sachs, & Co (NYSE: GS) in New York. Mr. Kelly received his Bachelor of Arts with honors from Dartmouth College and a Master of Business Administration from Harvard Business School. Mr. Kelly is a JBG Board Designee.Mr. Kelly was selected to serve on our Board based on his experience as a successful business leader and entrepreneur, as well as the breadth and depth of his experience in all facets of commercial and residential real estate investment, development, and operations.Mitchell N. Schear.Mr. Schear served as President of Vornado / Charles E. Smith from April 2003 until the formation transaction. Prior to joining Vornado in April 2003, Mr. Schear spent 15 years at the Kaempfer Company, where, as President, he oversaw all of the company's development, leasing and management activities. Mr. Schear has served on a number of boards on behalf of the real estate industry and the community, including The Washington Convention and Sports Authority; Executive Committee of the Federal City Council; the Downtown DC Business Improvement District; the Economic Club of Washington DC; the Corporate Board of Arena Stage; and is currently Vice Chair of the Board of Higher Achievement. He also serves on the Governor's Advisory Council on Revenue Estimates for the Commonwealth of Virginia. Mr. Schear has a Bachelor of Arts from Hobart College, and earned a Master of Business Administration from George Washington University. Mr. Schear is a Vornado Board Designee.Mr. Schear was selected to serve on our Board based on his 35 years of experience in commercial and residential real estate investment, development and operations, in particular his 14 years of experience and knowledge with respect to the assets received from Vornado in connection with the formation transaction.Ellen Shuman.Since August 2013, Ms. Shuman has served as the Managing Partner of Edgehill Endowment Partners, an endowment and foundation investment management firm. Prior to founding Edgehill Endowment Partners, Ms. Shuman served as Vice President and Chief Investment Officer of Carnegie Corporation of New York, a philanthropic foundation, from January 1999 to July 2011. Ms. Shuman served as the Director of Investments of the Yale Investment Office, which manages the endowment of Yale University, from 1986 to 1998. Ms. Shuman served as a trustee of Bowdoin College from 1992 to 2013 and as an investment advisor, trustee, and investment committee chair of the Edna McConnell Clark Foundation from 1998 to 2013. Ms. Shuman served as a board member of The Investment Fund for Foundations from 2000 to 2009. Ms. Shuman received her Bachelor of Arts degree, Magna Cum Laude, from Bowdoin College and a Master of Public and Private Management from the Yale University School of Management. Ms. Shuman is a JBG Board Designee.Ms. Shuman was selected to serve on our Board based on her experience in the management of investments for endowments and foundations.John F. Wood.Mr. Wood has been the General Counsel and Chief Legal Officer of the U.S. Chamber of Commerce since June 2018. Prior to joining the U.S. Chamber of Commerce, Mr. Wood served as a Partner at Hughes Hubbard & Reed LLP, a law firm from May 2009 until June 2018 and served as Chairman of the firm's Defense Industry Practice Group and Co-Chair of the Anticorruption and Internal Investigations Practice Group. Prior to joining Hughes Hubbard, Mr. Wood served as United States Attorney for the Western District of Missouri from April 2007 to March 2009. In that position, he was the senior federal law enforcement official for the district. He previously served in several other government positions, including Chief of Staff for the U.S. Department of Homeland Security (February 2005 to November 2006); Counselor to the Attorney General (July 2003 to February 2005), Deputy General Counsel for the White House Office of Management & Budget (April 2002 to July 2003), and Deputy Associate Attorney General / Counsel to the Associate Attorney General (March 2001 to April 2002). He previously practiced law at Kirkland & Ellis and was a law clerk for the Supreme Court of the United States and the U.S. Court of Appeals for the Fourth Circuit. He was a legislative aide to U.S. Senator John C. Danforth. Mr. Wood received his Bachelor of Arts withCharles E. Haldeman, Jr. INDEPENDENT TRUSTEE

Age: 73

Trustee Since: 2017

Committees: Audit, Corporate Governance and NominatingBackground

From July 2009 to June 2012, Mr. Haldeman served as the Chief Executive Officer of the Federal Home Loan Mortgage Corporation, a public government sponsored enterprise that operates in the U.S. secondary mortgage market. Mr. Haldeman joined the Federal Home Loan Mortgage Corporation from Putnam Investments, where he served as President and Chief Executive Officer from November 2003 to June 2008 and Chairman from June 2008 to June 2009. Mr. Haldeman served as the Non-Executive Chairman of KCG Holdings (NYSE: KCG) from November 2013 until July 2017. From 2012 until May 2021, Mr. Haldeman served as a member of the Board of Directors of S&P Global (NYSE: SPGI), including as the Non-Executive Chairman from April 2015 to October 2020 and as a member of the Financial Policy and Nominating and Corporate Governance Committees. Mr. Haldeman also served as the director of DST Systems (NYSE: DST) from November 2014 until April 2018. Mr. Haldeman received his Bachelor of Arts from Dartmouth College, Summa Cum Laude, a Master of Business Administration from Harvard Business School, where he graduated with high distinction as a Baker Scholar, and a Juris Doctor from Harvard Law School.

Qualifications

Mr. Haldeman was selected to serve on our Board based on his managerial experience, in particular his experience overseeing the Federal Home Loan Mortgage Corporation’s strategy, operating plans and financial goals.

W. Matt Kelly CEO/TRUSTEE

Age: 49

Trustee Since: 2017

Committees: NoneBackground

Mr. Kelly has served as our Chief Executive Officer and a member of the Board since our formation. Mr. Kelly worked at JBG from August 2004 until our formation in 2017 and served as Managing Partner and a member of JBG’s Executive Committee and Investment Committee from 2008 to our formation. Mr. Kelly was responsible for the day to day oversight of JBG’s investment strategy and the investment and acquisition activity of the JBG Legacy Funds. Prior to joining JBG, he was cofounder of ODAC Inc., a media software company, which he helped start in March 2000, and prior to that worked in private equity and investment banking as an analyst with Thomas H. Lee Partners in Boston, and Goldman Sachs, & Co (NYSE: GS) in New York. Mr. Kelly is a Trustee of the Urban Institute and serves as a member of the Nareit Executive Board and the Real Estate Roundtable. He also serves as Chairman of the Board of the Medstar Health Washington Hospital Center. Mr. Kelly has served in a number of academic posts including as an Executive in Residence of the Steers Center at the McDonough School of Business at Georgetown University. Mr. Kelly received his Bachelor of Arts with honors from Dartmouth College and a Master of Business Administration from Harvard Business School.

Qualifications

Mr. Kelly was selected to serve on our Board based on his experience as a successful business leader and entrepreneur, as well as the breadth and depth of his experience in all facets of commercial and residential real estate investment, development, and operations.

2022 PROXY STATEMENT 15 Honors from the University of Virginia and his Juris Doctor, magna cum laude, from Harvard Law School. Mr. Wood is a Vornado Board Designee.Mr. Wood was selected to serve on our Board based on his extensive experience in the federal government and his legal experience advising companies and boards of directors on compliance, governance, and other matters.Class III TrusteesScott A. Estes.Mr. Estes served as the Executive Vice President and Chief Financial Officer of Welltower Inc. (NYSE: HCN), a real estate investment trust focused on healthcare infrastructure from January 2009 through October 2017. Mr. Estes joined Welltower Inc. in April 2003 from Deutsche Bank Securities, a financial firm, where he served as Senior Equity Analyst and Vice President from January 2000 to April 2003. Since June 2018 Mr. Estes has served on the Board of Directors of Essential Properties Realty Trust (NYSE: EPRT), a real estate investment trust that acquires, owns and manages primarily single-tenant properties, where he serves as the chair of the Audit Committee and a member of the Compensation and Nominating and Corporate Governance Committees. Mr. Estes received his Bachelor of Arts from the College of William and Mary. Mr. Estes is a JBG Board Designee.Mr. Estes was selected to serve on our Board based on his financial and business experience as Chief Financial Officer of a large real estate investment trust.William J. Mulrow.Mr. Mulrow has served as a senior advisor to Blackstone, an alternative asset manager, since May 2017. Mr. Mulrow has served as a Director of Consolidated Edison, Inc. (NYSE: ED) since November 2017, Arizona Mining Inc. (TSX: AZ) since June 2017, and Titan Mining Corporation (TSX: TI) since October 2018. From January 2015 to April 2017, Mr. Mulrow served as Secretary to Andrew M. Cuomo, Governor of the State of New York. Prior to his service in the Governor's office, Mr. Mulrow worked as a Senior Managing Director at Blackstone (April 2011 — January 2015). Mr. Mulrow has also worked in senior positions at Paladin Capital Group, Citigroup (NYSE: C), Rothschild and Donaldson, Lufkin and Jenrette Securities Corporation. Mr. Mulrow has served in a number of academic posts including the Board of Advisors for the Taubman Center for State and Local Government at the Harvard University John F. Kennedy School of Government and on the Board of the Maxwell School of Citizenship and Public Affairs at Syracuse University. Mr. Mulrow received a Bachelor of Arts, Cum Laude, from Yale University and a Master of Public Administration from the Harvard University John F. Kennedy School of Government. Mr. Mulrow is a Vornado Board Designee.Mr. Mulrow was selected to serve on our Board based on his more than 30 years of experience in business, government and politics.Steven Roth.Mr. Roth has been the Chairman of the Board of Trustees of Vornado since May 1989 and Chairman of the Executive Committee of the Vornado board since April 1980. From May 1989 until May 2009, Mr. Roth served as Vornado's Chief Executive Officer, and has been serving as Chief Executive Officer again from April 15, 2013 until the present. He is a co-founder and Managing General Partner of Interstate Properties since September 1968. He has also served as the Chief Executive Officer and Chairman of the Board of Alexander's, Inc. since March 1995 and May 2004, respectively, and has served as a trustee of Urban Edge Properties since the completion of its spin-off from Vornado in January 2015. Mr. Roth was a director of J. C. Penney Company, Inc. (a retailer) (NYSE: JCP) from February 2011 until September 2013. Mr. Roth is a graduate of DeWitt Clinton High School in the Bronx. He received his Bachelor of Arts degree from Dartmouth College and a Master of Business Administration degree with Highest Distinction from The Tuck School of Business at Dartmouth. Mr. Roth is a Vornado Board Designee.Mr. Roth was selected to serve on our Board based on his 48 years of experience in all facets of commercial and residential real estate investment, development and operations.Alisa M. Mall INDEPENDENT TRUSTEE

Age: 44

Trustee Since: 2020

Committees: Corporate Governance and Nominating

Other Current Public Boards: FS Development Corp. IIBackground

Ms. Mall is a managing director at Foresite Capital responsible for corporate development, longterm capital strategy, investor relations and ESG engagement, a position she has held since November 2020. Prior to Foresite Capital, Ms. Mall served at Carnegie Corporation from 2009 to October 2020, where she was most recently Managing Director, Investments managing the corporation’s real assets portfolio, and prior to which she served as Associate Director of Investments. Prior to Carnegie Corporation, Ms. Mall served as Director, Equity Capital Markets, at Tishman Speyer Properties from 2007 to 2009. She previously practiced law as a real estate associate at the law firm Orrick, Herrington & Sutcliffe. Ms. Mall has served on the board of FS Development Corp. II (NASDAQ: FSH) since February 2021. She also serves on the boards of the Pension Real Estate Association (PREA), Breakthrough New York, and the Bronfman Fellowship and is a member of the investment committee of UJA Federation of New York. She received her Juris Doctor from Stanford Law School and her Bachelor of Arts, magna cum laude, from Yale University.

Qualifications

Ms. Mall was selected to serve on our Board based on her experience making and overseeing real estate portfolio investments.

Carol A. Melton INDEPENDENT TRUSTEE

Age: 67

Trustee Since: 2017

Committees: Compensation (Chair)

Other Current Public Boards: The RealReal, Inc.Background

Ms. Melton is the Chief Executive Officer and founder of Adeft Capital, a venture capital firm advising and investing in new innovative companies in a variety of sectors, which she founded in August 2018. Ms. Melton previously served as a senior executive officer of two global media and entertainment companies (formerly known respectively as Time Warner Inc. and Viacom). At Time Warner, Ms. Melton served as Executive Vice President of Global Public Policy from June 2005 until August 2018. Ms. Melton joined Time Warner from Viacom, where she served as Executive Vice President for Government Relations from June 1997 to June 2005. Ms. Melton is a member of the Council on Foreign Relations and serves on the Board of Directors and as First Vice President of the Economic Club of Washington, DC. Ms. Melton has also served on the Board of Directors for The RealReal, Inc. (NASDAQ: REAL) since August 2020. Ms. Melton received her Bachelor of Arts degree from Wake Forest University, a Master of Arts from the University of Florida and a Juris Doctor from the Washington College of Law at American University.

Qualifications

Ms. Melton was selected to serve on our Board based on her experience in strategic oversight of policy related activities for global businesses.

16 JBG SMITH PROPERTIES Robert A. Stewart.Mr. Stewart serves as Executive Vice Chairman of our Board. Mr. Stewart worked at JBG from June 1988 until the formation transaction, serving as Managing Partner and Chair of the Investment Committee, and, during his tenure with JBG, focused on the acquisition, financing and disposition of JBG investments, conceiving development plans for JBG assets and the asset management and fundraising processes. Mr. Stewart served as a member of JBG's Executive Committee since its formation until the formation transaction. Mr. Stewart received his Bachelor of Arts from Princeton University and a Master of Business Administration from The Wharton School of the University of Pennsylvania. Mr. Stewart is a JBG Board Designee.Mr. Stewart was selected to serve on our Board based on his experience as a successful business leader, as well as his extensive experience in all facets of commercial and residential real estate investment, development, and operations.Trustees are elected by plurality vote. Therefore, the four trustee nominees receiving the highest number of "FOR" votes will be elected. There is no cumulative voting in the election of trustees. For purposes of this Proposal One, abstentions, votes marked "WITHHOLD" and other shares not voted (whether by broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the result of the vote.THE BOARD OF TRUSTEES RECOMMENDS A VOTE "FOR"ELECTION OF EACH OF THE NOMINEES SET FORTH ABOVE.William J. Mulrow INDEPENDENT TRUSTEE

Age: 66

Trustee Since: 2017

Committees:

Audit, Compensation

Other Current Public Boards:

Consolidated Edison, Inc., Titan Mining CorporationBackground

Mr. Mulrow has served as a senior advisor to Blackstone, an alternative asset manager, since May 2017. Mr. Mulrow has served as a Director of Consolidated Edison, Inc. (NYSE: ED) since November 2017 and Titan Mining Corporation (TSX: Tl) since October 2018. Mr. Mulrow previously served as a Director of Arizona Mining Inc. (TSX: AZ) from June 2017 until June 2018. From January 2015 to April 2017, Mr. Mulrow served as Secretary to Andrew M. Cuomo, former Governor of the State of New York. Prior to his service in the Governor’s office, Mr. Mulrow worked as a Senior Managing Director at Blackstone from April 2011 to January 2015. Mr. Mulrow has also worked in senior positions at Paladin Capital Group, Citigroup (NYSE: C), Rothschild and Donaldson, Lufkin and Jenrette Securities Corporation. Mr. Mulrow has served in a number of academic posts including the Board of Advisors for the Taubman Center for State and Local Government at the Harvard University John F. Kennedy School of Government and on the Board of the Maxwell School of Citizenship and Public Affairs at Syracuse University. Mr. Mulrow received a Bachelor of Arts, Cum Laude, from Yale University and a Master of Public Administration from the Harvard University John F. Kennedy School of Government.

Qualifications

Mr. Mulrow was selected to serve on our Board based on his more than 30 years of experience in business, government and politics.

D. Ellen Shuman INDEPENDENT TRUSTEE

Age: 67

Trustee Since: 2017

Committees:

Audit, Corporate Governance and NominatingBackground

Ms. Shuman has served as the Chair of the Investment Advisory Council of the State of Connecticut, to which she was appointed by Governor Ned Lamont, since May 2020. From August 2013 until May 2020, Ms. Shuman was the Managing Partner of Edgehill Endowment Partners, an investment firm that manages the endowments of mission-based institutions. Prior to founding Edgehill Endowment Partners, Ms. Shuman served as Vice President and Chief Investment Officer of Carnegie Corporation of New York, a philanthropic foundation, from January 1999 to July 2011. Ms. Shuman served as the Director of Investments of the Yale Investment Office, which manages the endowment of Yale University, from 1986 to 1998. Ms. Shuman served as a trustee of Bowdoin College from 1992 to 2013. Ms. Shuman served as a director of Meristar Hospitality Corporation from 2001 until its take-private acquisition by Blackstone in 2006 and as a director of General American Investors from July 2004 through April 2013. Ms. Shuman received her Bachelor of Arts degree, Magna Cum Laude, from Bowdoin College and a Master of Public and Private Management from the Yale University School of Management.

Qualifications

Ms. Shuman was selected to serve on our Board based on her experience in the management of investments for endowments and foundations.

2022 PROXY STATEMENT 17 Robert A. Stewart CHAIRMAN OF THE BOARD

Age: 60

Trustee Since: 2017

Committees:

NoneBackground

Mr. Stewart served as our Executive Vice Chairman from our formation until July 2020, when he resigned from the Company, and currently serves as Chairman of our Board. Mr. Stewart worked at JBG from February 1988 until our formation in 2017, serving as Managing Partner and Chair of the Investment Committee, and, during his tenure with JBG, focused on the acquisition, financing and disposition of JBG investments, conceiving development plans for JBG assets and the asset management and fundraising processes. Mr. Stewart served as a member of JBG’s Executive Committee until our formation. Mr. Stewart received his Bachelor of Arts from Princeton University and a Master of Business Administration from The Wharton School of the University of Pennsylvania.

Qualifications

Mr. Stewart was selected to serve on our Board based on his experience as a successful business leader, as well as his extensive experience in all facets of commercial and residential real estate investment, development, and operations.

18 JBG SMITH PROPERTIES PROPOSAL TWO: ADVISORY VOTE ON EXECUTIVE COMPENSATION

Advisory Vote on Executive CompensationPursuant to Section 14A of the Securities Exchange Act of 1934, as amended (the

"Exchange Act"“Exchange Act”), our shareholders are entitled to cast a non-binding advisory vote at the Annual Meeting to approve the compensation of our named executive officers, as disclosed pursuant to theSEC'sSEC’s compensation disclosure rules, including the"Compensation“Compensation Discussion andAnalysis"Analysis” section of this Proxy Statement, the compensation tables and accompanying narrative disclosures. We refer to this as our"Say-on-Pay"“Say-on-Pay” vote. While this Say-on-Pay vote is an advisory vote that is not binding on the Company or the Board, we value the views of our shareholders, and theBoard'sBoard’s Compensation Committee, which administers our executive compensation program, will consider the outcome of the vote when making future compensation decisions. The Board has adopted a policy, which shareholders approved by a non-binding advisory vote, of providing for an annual Say-on-Pay vote. Accordingly, we anticipate that the next such vote will occur at the 2023 annual meeting of shareholders.The primary objectives of our executive compensation are to (1) align the interests of our executives with those of our shareholders; (2) attract and retain the highest caliber executives in our industry; and (3) motivate executives to achieve corporate performance objectives as well as individual goals. To fulfill these objectives, we have an executive compensation program that includes three major

elements—elements — base salary, annual bonus incentives and long-term equity incentives, which may include stock options, restricted shares or partnership unit awards and performance-based equity awards. When determining the overall compensation of our named executive officers, including amounts of base salaries,andannual bonus incentives and long-term equity incentives,amounts,the Compensation Committee considers a number of factors it deems important, including:•- the executive

officer'sofficer’s experience, knowledge, skills, level of responsibility and potential to influence our performance;•the business environment, our strategy, and our financial, operational and market performance;•corporate governance and regulatory factors related to executive compensation; and•marketplace compensation levels and practices.The Compensation Committee comprises